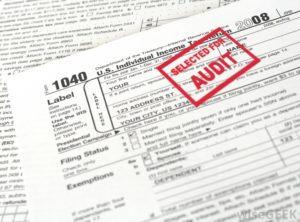

What is Alernative Minimum Tax?

The alternative minimum tax (or AMT) was created many years ago to ensure that higher-income taxpayers with lots of deductions and credits pay at least a minimum amount of tax.

The AMT is a separate tax calculation that disallows many of the deductions and credits used to calculate regular income tax. It also adds back certain income that is not normally taxed. The most common AMT adjustments are for certain itemized deductions and adjustments, such as state and local taxes. Also, if you exercise incentive stock options, sell investments with large long-term capital gains, or take depreciation on business property, you may be hit with the AMT.

You’re required to calculate your tax under both the regular and AMT methods. You then pay whichever tax is higher.

Contact us for more information.