The Benefits of Being a Sole Proprietor

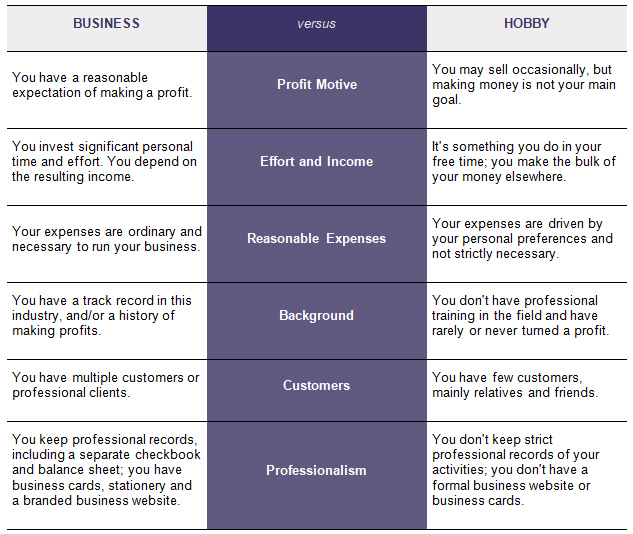

Many start-up businesses move from hobby status to a business when they start to make a profit. The tax entity typically used is a sole proprietorship. Taxes on this business activity type flow through your personal tax return on a Schedule C. Here are some benefits to consider if you’re trying to decide if being a sole proprietor is right for you:

- You can hire your kids and decrease your tax bill. As a sole proprietor, you can hire your kids and avoid paying Social Security and Medicare taxes for their work. While there are exceptions, this can generally save your small business over 7.65% on their wages.

- Your kids can benefit, too. Any income your kids earn that’s less than $12,950 isn’t taxed at the federal level. So this is a great way to build a tax-free savings account for your children. Remember, though, that their work must reflect actual activity and reasonable pay. So consider hiring your kids to do copying, act as a receptionist, provide office clean up, advertising or other reasonable activities for your business.

- Fewer tax forms and filings. As a sole proprietor, your business activity is reported on a Schedule C within your personal Form 1040 tax return. Other business types like an S corporation, C corporation or a partnership must file separate tax returns, which makes tax compliance a lot more complicated.

- More control over revenue and expenses. You often have more control over the taxable income of your small business as a sole proprietor. This can provide more flexibility in determining the timing of some of your revenue and business expenses, which can be used as a great tax planning tool.

- Hire your spouse. If handled correctly, a spouse hired as an employee can work to your advantage as a sole proprietor. As long as the spouse is truly an employee of the business, the sole proprietor can benefit as a member of their employee’s (spouse’s) family benefits. This can include potential medical expense reimbursements.

- Funding a retirement account. You can also reduce your business’s taxable income by placing some of the profits into a retirement account like an IRA. As a sole proprietor, you can readily manage your marginal tax rate by controlling the amount you wish to set aside in this pre-tax retirement account.

- It’s not all roses. While there are many benefits of running your business as a sole proprietor, don’t forget the drawbacks. One of the most significant drawbacks is the lack of personal legal protection, which is a feature in other business forms like corporations and Limited Liability Companies. Most sole proprietors address this with proper business insurance, so do not overlook the need to find coverage for yourself.

Please call if you have questions about your sole proprietor business.