Retirement Plan Options for Small Business Owners

Offering a retirement plan can be a powerful tool when you’re competing to attract the best employees. And if you’re a sole proprietor, a retirement account can help you save even more money for the future. Here are some of the most popular retirement options for small business owners, along with ways to help with the cost of starting and operating a retirement plan.

Retirement Plan Options

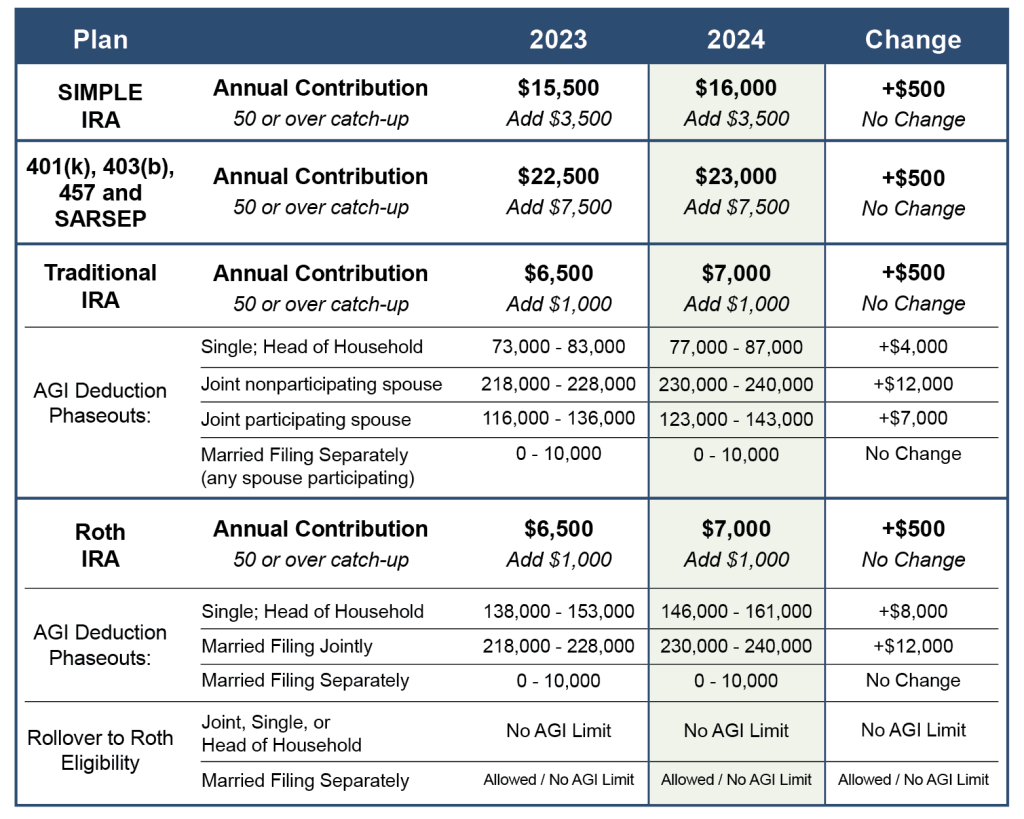

- Simplified Employee Pension (SEP) IRA Account. Contribute as much as 25% of your business’s net profit up to $69,000 for 2024.

- 401(k) Plan. Contribute up to $69,000 of your salary and/or your business’s net profit.

- Savings Incentive Match Plan for Employees (SIMPLE) IRA Account. You can put all your business’s net profit in the plan, up to $16,000 plus an additional $3,500 if you’re 50 or older.

Tax Breaks to Start a Retirement Plan

- Tax Credit for Startup Costs. A tax credit equal to 100 percent of the administrative costs for establishing a workplace retirement plan is available for up to three years for eligible businesses with 50 or fewer employees. Businesses with 51 to 100 employees can still be eligible, which caps the credit at 50% of administrative costs and with an annual cap of $5,000.

Taking advantage: This credit could potentially cover all set-up and administrative costs during the first three years of a plan’s existence, as average 401(k) set-up costs range from $1,000 to $2,000, while average annual administrative costs range from $1,000 to $3,000. To keep your annual administrative costs as low as possible, it may be worth shopping around to look at different plan providers as the fees can vary. - Tax credit for employer contributions. Eligible businesses with up to 100 employees may qualify for a tax credit based on its employee matching or profit-sharing contributions. This credit, which caps at $1,000 per employee, phases down gradually over five (5) years and is subject to further reductions for employers with 51 to 100 employees.

Taking advantage: Once this tax credit expires after the plan’s first five years of existence, employer contributions to 401(k), SEP, and SIMPLE plans are still tax deductible up to certain limits. This means that both the employer and employee can continue to reap tax savings for the entire life of the retirement plan.

And remember that employees can still contribute to their own individual IRA. So let your employees know that in addition to having either a 401(k), SEP, or SIMPLE account through your company, they may also qualify to contribute to their own traditional IRA or Roth IRA.

It’s never been easier or more affordable to start a retirement plan for your business, so if you have not already done so, look into the alternatives that best fit your business. Contact us today!