Investing basics: Try dollar-cost averaging

The secret to success in the stock market is to buy low and sell high. That’s much easier said than done, since an investor’s natural inclination is to buy a stock when it’s on the way up and to sell it when it’s on the way down. For the long-term investor, there’s one technique that can be used to build a solid portfolio without being battered by the up-and-down swings of the market.

It’s a technique called dollar-cost averaging. Very simply, you invest a given amount of money at given intervals without concerning yourself about the stock’s price on that given day.

For example, you might put $200 a month in a good quality stock or mutual fund. Instead of trying to identify the low point for the stock and buying it then, you simply buy whatever number of shares your $200 will purchase on the same day each month.

Assuming that the share price of your stock increases over the long term, your average cost per share is always lower than the current market value.

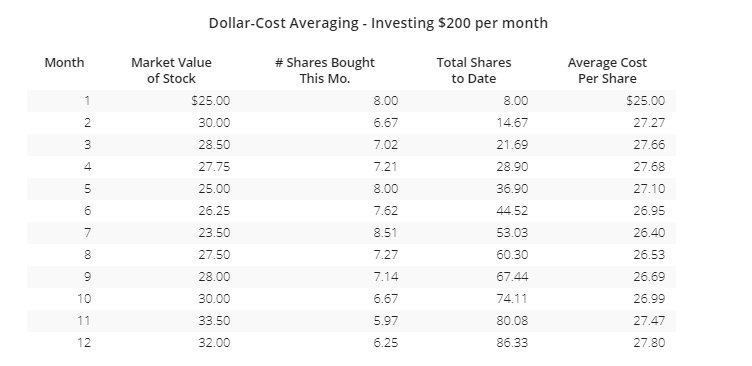

Look at the following chart to see a typical example of dollar-cost averaging.

Note that in Month #5, your average cost is $27.10, which is $2.10 more than the market value. Time to panic? No, the market moves in cycles, going up and down. As long as the long-term movement is up, you come out ahead.

Notice that after Month #12, you would have purchased 86.33 shares for a total investment of $2,400. Your average cost per share is $27.80, and the current market value is $32. Your $2,400 investment has increased by $363 to $2,763, giving you about a 15% return.